Note: This post is also available in audio format on the Abraham’s Wallet podcast (on iTunes, Google and Spotify).

Proverbs 22:7 The rich rule over the poor, and the borrower is the slave of the lender.

So you’ve budgeted your heart out. Nice work. And you are spending less than you are earning. Enthusiastic high five! And your budget has revealed to you that you previously thrown off cash like a Kardashian jettisons marriages (We’ll be here all night! Try the shrimp!)? Womp womp. The result of your former ways may very well be (in fact, statistically speaking, almost certainly is…) the American Dream-maker… DEBT! Or you may have mountains of debt and framed papers on your wall to show for it. Or perhaps a lovely 4 bedroom craftsman-style home, replete with open concept kitchen remodel with bleached faux barn wood flooring. Regardless of how you got here… shall we consider how to deal with debt? (Yes, let’s!)

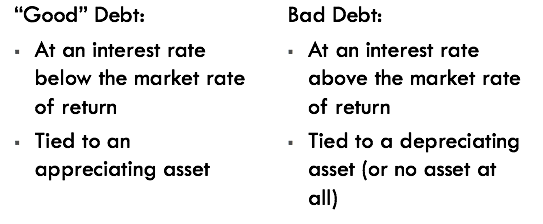

Debt principle #1 – debt can be good or bad

BAD DEBT is debt that grows at an increasing pace and is tied to assets that shrink (or vanish) at an increasing pace. Items that fall into this bucket would include: credit card debt (“but i invested in all of those experiences” you say! …er, yeah…), automobile loans, consumer loans (buy now, pay later), etc. This is anything that you spent $ on and found yourself left with either nothing or a thing that is worth less every day. In hindsight, let’s just call all of those purchases BAD DECISIONS. At the Wallet, we’re all for spending money on celebration and experience from time to time – but we only spend money that we have for those things. Otherwise we act a fool.

Good debt, then, has the opposite characteristics. Money that is borrowed at a rate below the rate of return that we would expect to get via an investment, could be good debt. (Say, you borrow money at 2% interest to buy into an asset that produces at a 10% rate.) Also, good debt is tied to an asset that increases in value – like, in some circumstances, a house or business.

Debt principle #2 – debt can be a tool or a trap

Because debt can be a tool or a trap, your goal is to become very skilled at avoiding all of the traps and wielding the tool when necessary. For most of you, trap avoidance (and in some cases, self-extraction) will be the ONLY order of business… for a very long time (like, decades).

Jesus himself scolds the fool who would fail to deploy the dollars under his care, so we should take it rather seriously that we have an obligation to get a good return on our money. Borrowing to fund a new pickup truck will not only provide no return, it will make it difficult for us to put other dollars that will be coming our way to good use. Think of the backstory to the foolish servant in Matthew 25 as, “Sorry master, I had to pay the minimums on my credit cards, so I couldn’t grow the money you gave me”. Not good.

Modern “bad” debt is particularly trappy in its nature. It is constructed with tempting “0% APR no payments for 18 months!” introductory periods. And then, after 18 months and one day, you owe more than you ever thought possible, and the debt is growing at 25% per year. “Good” debt can also be a trap. The fact that you think a house is going to grow in value does not give you any sort of permission to go overspend on a home. Because the use of debt leverages you, both good and bad decisions have a much bigger impact on you, the borrower, than they would were you investing with cash.

The call to becoming shrewd managers also means we aren’t afraid to use debt wisely. No Fortune 50 company would even consider a strict no-debt policy, because they’ve grown skilled at the use of this tool. If you have even an inkling of doubt, opt against taking on any new debt, but know that your destiny here is to feel comfortable using it when appropriate.

Debt principle #3 – repay your debts

Amen, amen, and hallelujah. Repayment of bad debt is relatively easy to prioritize – attack the biggest pain points first. Sometimes that means just paying off the highest interest rate loans in the “bad” category first. You can also pay off the smallest “bad” debts first, and use the money that would have gone towards servicing that debt to pay the bigger “bad” items faster. Dave Ramsey does a great job capturing these options in his debt snowball plan. We’re big fans. Get out the torch of MAXIMUM payments, and burn that mother down.

Once you kill the toxic debt (wooo!) you basically get to start putting your overall financial plan into warp drive, investing and collecting assets for your family. Until then, you’re just bailing water out of your boat and plugging leaks. Saving and paying off debt, especially when you’re young (say, in your first year of marriage), can be thought of as two sides of the same coin. Here’s a simple rubric for thinking about how to prioritize debt payoff:

- Paying down a loan that has a 7.5% interest rate is just as good as investing your money at a 7.5% guaranteed return (…in today’s market, a no-brainer).

- Good stewards are not afraid to use debt, but only as a tool, and never to spend money that they don’t have.

- If you have a set amount of your income allocated to savings and debt payoff, you can be flexible, taking advantage of good opportunities for one or the other.

- If the decision is a wash once you run the numbers, have a bias towards paying off debt.

For what it’s worth, I’ve got experience with good, bad and borderline-neutral debt. My wife and I repaid $230k of student loans, bought an expensive car on credit (dumb) and have flipped houses to our great profit using rather complicated mortgage loans. Stay with me for deeper dives on various types of debt, but first get your hands around the three principles above. Now get out your torch and start destroying that debt with Abrahamic fervor!