Note: This post is also available in audio format on the Abraham’s Wallet podcast (on iTunes, Google and Spotify).

This article is part 1 of a 4-part series about having your own Goals Summit every year. Here’s links to parts 2, 3 and 4.

Ok fellas, here it is: the beginning of a new year. The financials are in; you had a good but not great year and… what do you think going forward? Do you just hope it’ll work out better on the next go round?

No, that’s what lazy wieners do. YOU, on the other hand, sit down, get out your annual financial summary from this past year, and get to work, you family builder, you.

My wife and I go on a goal planning retreat (The Summit) at the end of every year. At The Summit, we cover a lot (all 5 capitals actually – more on those later), but finances are an important part of it—and will be the focus of this post. As I write this, I’ve got last years summary and goals in front of me (my wife, bless her soul, is the accountant on the team. She creates P+L statements for each of our summits and monitors the monthly spending and cashflow). We break our financial goals up into 3 big buckets:

PERSONAL. This is a goal that’s just about you, or just about your wife. It’s not about the budget or about some big vision, necessarily. It’s just something you’re walking toward, between you and God. This could mean decreasing the amount you spend on alcohol, or earning more with your side hustle, or making your first real estate investment (which you would want to learn about first, which would be intellectual capital… but I digress). Last year our personal goals were simple: I wanted to give out $500 in cash, over the course of the year. (Writing a check is easy, handing cash to somebody who you know needs it is a bit more awkward… but way more rewarding.) My wife’s personal goal was to take time monthly to prepare better for our summits (we have 3 each year, just to review the goals we created at the end of the previous year). Isn’t that a great goal for a Sara-ish woman?! Anyway, you get the idea. You can have more than one, but you should have at least one. Come up with the goals in this bucket by asking: Where is God putting His finger re: my wallet, and how can I start practicing a new skill or growing an existing one? (My goals this year are: buy a scooter to start enjoying with my kids and save some $ on commuting; give $500 cash again; and purchase land.)

FAMILY. These are goals that affect your marriage and home, and will ultimately require a team effort to execute. These are the ones that require conversation and some strategy. They’re also the most fun, to me, because they’re about dreaming. They including spending limits, based on last year’s summary (or, if this is your first year, an educated guess of what a responsible number would be), such as:

Clothing was a bit out of control for us two years ago. So it’s on last year’s goals sheet. We like where we’re ending up, but we’ll probably put that number down again (since it’s probably my wife’s favorite luxury).

Food. Holy moly the food. We love the foods up in my crib, and it’s always something that has to be limited. We watch this closely and separate it from…

Eating Out. Because of Family Fun Nights and Date Nights (all covered in our “relationships” goals), eating out will never go away for our family. But we also know we can have a great time (and eat delicious food) on $35 at Chipotle just as easily as we can spend $200 at the Downtown Nosh House du Jour. So we set a number, break that into months, and follow it.

Personal Care. If your particular family includes Adult Females (mine has one, and two in training), you have to watch this number. They allllllllll seem to enjoy the dispensing of money on such throwaway items as “nail treatments”, “eyebrow shaping” and “hair coloring”. (Why does my haircut, with tip, come in at $20 and my wife’s is $200? Ever wondered that?) I’m all for the enjoying of my womenfolk, but we just need limits.

But of course life’s about more than spending limits. We also have spending goals:

Giving is an important part of our family culture, and if something is important to you, it’ll have hours and dollars connected to it. We have dollar amounts connected to important places we want to give, and we have an overall percentage that we aim for (my wife and I have been believers a long time, so we don’t EVER consider a tithe an appropriate reference for giving. We want to give far above ten percent.) This is very very fun work, coming up with these numbers.

Saving and Investing*. As you’d imagine, we want these numbers to increase every year. My wife and I balance saving cash (we have a bit of a war chest that we grow incrementally), investing (both in the market and in small businesses with friends), and purchasing long-term Family Assets like property. You might not think of that as an investment, but we do: to us, an investment is something that I don’t need to live on, that I hope to pay off for my grandchildren. Family assets like property fit into that definition quite well. [*Some of you won’t think of saving and investing as “spending”, but to me, every place where I put a dollar that is no longer under my control is spending.]

Spiritual growth Until a few years ago, I never even considered the idea of strategically putting money toward my family’s spiritual development. That was dumb of me; I blame Church World. Anyhow, now it’s not only a value, it’s a category for which we have an annual spending goal (and we also try to take a trip a year specifically to grow ourselves or our kids spiritually). Use that money right!

Creative or business endeavors In addition to being a wildly successful blogger (It’s a joke!), I am a songwriter. Some years, this has earned me thousands of dollars and been my sole source of income. (And other years, I am sent dozens of cents by iTunes.) As my wife and I weigh the coming year, we ask, what ventures will we want to invest time and money in? Recording music isn’t free (at least, not if you want to honor the people who’re helping you do so… we are NOT fans of believers begging and stealing time from generous people) so we put that money aside. Similarly, if I want to write, we count on my not earning money while I do that.

After personal and family, our last bucket is…

OUT: BUSINESS AND MINISTRY. My wife runs a business we started (I am her sometimes-employee) and so we have goals there:

- Sales numbers

- Gross profit

- Profit margin

- Net profit

- Gross revenues

- Spending limits

It doesn’t matter if you’re running a factory or a lemonade stand, you should be looking at those numbers and talking about them as a family. (BTW, my children aren’t old enough to bring into The Summit fully, but I can’t wait until we can! They won’t make decisions with me and my wife—at least not the major ones—but they are being groomed into the repercussions of them, since my wife and I talk about them all the time.)

As for ministry, we do hosting in our home for various kinds of Jesus-y meetings (including a big, fancy feed during Passover… pricey!), and I take guy to coffee nearly every week in an effort to make disciples. These things cost money and, not only do I not want to be miserly about them, I WANT to put money toward them! But I have to plan for it. Isn’t that true of all of our financial goals, really?

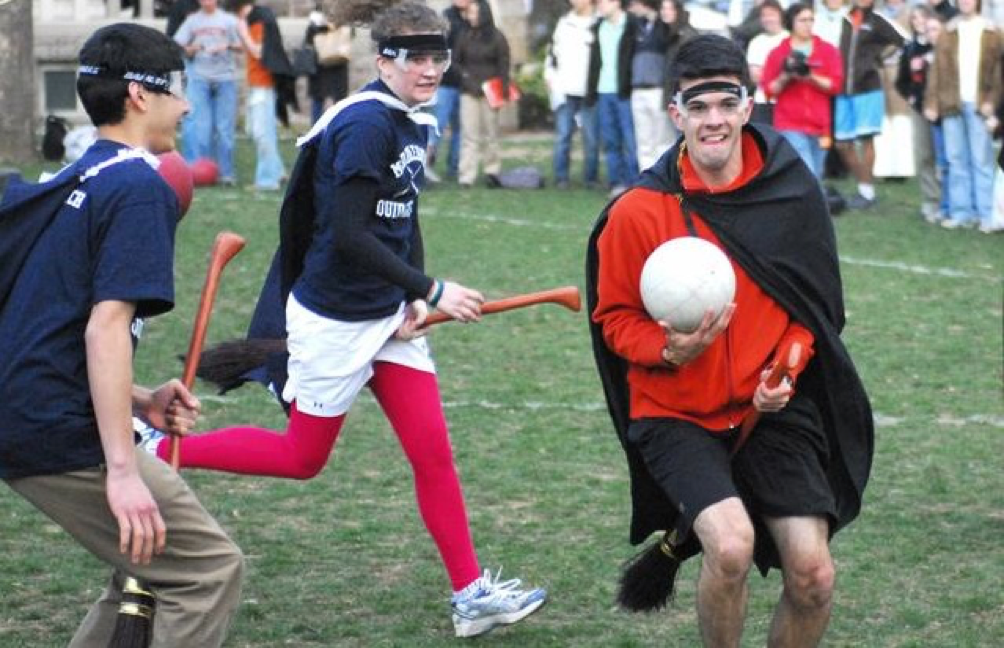

So those are our 3 big buckets! Can you see how delightful summits are, talking through tens (or hundreds!) of thousands of dollars entrusted to us by our Father Who says, with wide and curious eyes of love, “So… what are you guys gonna get done THIS year…?” A cool and amazing promise: once you start setting goals, you’ll be utterly amazed at how you can “speak things into existence” just the way that your Abba does. Once you declare something a goal, you set yourself up to capture the opportunity when it comes along. You know, like Denzel says. (We can only assume that Denzel also loves Abraham… and despises Quidditch.)

And quidditch is for ninnys!